Issuing Green Bonds – and garnering investor interest

Green bonds are taking off as the investment vehicle of choice for the private and public sectors to finance projects with environmental benefits, such as clean power, low-carbon transport and energy efficient buildings. During recent years, governments have started to promote the development of the green bond market, and investors have taken a keen interest in ‘green’ investments.

If your organization is looking at raising capital for new investments or to refinance existing capital, green bonds may provide an interesting avenue. They can provide the additional benefits of attracting new investors and increase publicity around the sustainable agenda of your organization.

Green bonds can be used to fund or refinance past or future investments in a broad range of categories, including:

- Energy efficiency upgrades (including efficient buildings)

- Renewable energy infrastructure

- Sustainable waste management

- Sustainable land use (including sustainable forestry and agriculture)

- Sustainable biodiversity, and water management projects and infrastructure

- Green buildings

- Low-carbon transport

- Climate adaptation infrastructure

- Clean Water

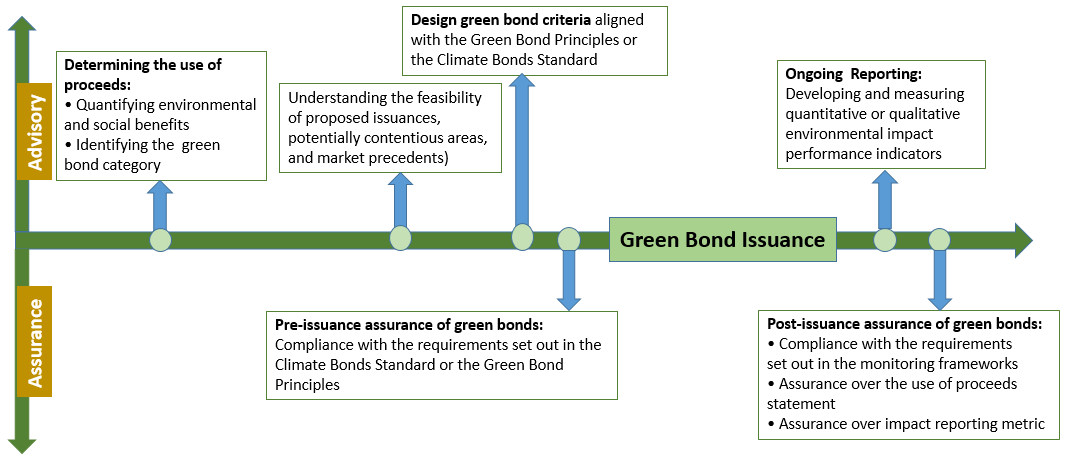

Liberty Energy Advisory and Assurance services :

There are four types of green bonds:

- Green “Use of Proceeds” bond: secured by assets (comparable to standard bonds)

- Green “Use of Proceeds” revenue bond: secured by income-producing projects.

- Green project bond: secured by a projects assets and balance sheet.

- Green securitized bond: secured by a larger asset pool.

Our Advisory services include:

- Providing you with an understanding of what projects could be funded by green bonds

- Helping you decipher the financial feasibility of the investment

- Helping you assess which issuance process would be most suitable for your business

- Helping you meet the requirements of the most appropriate green bond issuance process

- Assisting you to develop the appropriate reporting metrics to report on the impact of green bonds

Our Assurance services include:

- Pre-issuance verification that the bond is compliant with the selected green bond issuance process

- Post-issuance verification to confirm that the bond remains compliant with the issuance process

- Verification that reporting on the use of proceeds is properly described

- Verification that impact reporting metrics are appropriately reported

Issuing a Green Bond – The Nuances

The green bond issuance process is similar to that of a regular bond, with an added emphasis on governance, traceability and transparency designed to increase investors’ confidence in the green credential of the bond, and prevent accusations of ‘greenwashing’ to the issuer. Below is a simple outline of a generic green bond issuance process.

- Review funding options

- Choose Underwriter

- Design green bond criteria and project selection process - Issuers can look to several evolving guidelines and sources such as the Green Bond Principles, the Climate Bonds Standard, national guidelines, green bond indices and sector-specific standards for guidance in defining their green bond and the process used to determine the eligibility of projects.

- Registration / Application

- Processes and controls for use/management of proceeds - Setting up robust management and controls for tracking and allocation of proceeds is recommended to ensure the proceeds are used in line with the terms of the bond.

- Information disclosure

- Get Credit Rating

- Issue Bond

- Allocation of proceeds

- Ongoing reporting

Investor demand for green bonds continues to grow as Environmental, Social and Governance (ESG) criteria become increasingly important. Institutional investors, ESG investors, governments, corporate treasuries and retail investors are all including green bond projects into their portfolios.

The Liberty Energy Edge

Why Liberty Energy Group?

Our customers prefer working with us for our unparalleled financing and deal underwriting experience globally. Our responsiveness and a problem-solving approach where we use our specialized industry experience to deliver a one-on-one relationship with our clients is one of the many advantages Liberty Energy Group offers.