Project Finance with Liberty Energy

We deliver project finance solutions on a globally along with an infallible commitment to make every client deal more profitable. Liberty Energy provides the project financing you need with deal structuring and advisory services that mitigate risk and aggressively safeguards your interests.

With more than two decades of deal structuring experience with some of the world’s biggest banks and financial institutions, our directors give us unparalleled expertise coupled with the strength derived from having strategic relationships with many of the world’s top lenders and financial institutions. From that foundation, we develop some of the most innovative project funding solutions in the world and source unique project funding alternatives through capital markets and lenders worldwide.

Our expertise in delivering successful project financing packages and our innate ability to match the right project with the right lenders, architects, engineers, consultants, builders, developers and all of the professionals your project will need is uncanny. Doing it seamlessly and at the right time gives us all the tools we need to arrange and deliver extraordinary financial solutions for challenging, difficult to place loans and projects.

Sustainability in international project financing means delivering at the most difficult of times. By utilizing our strengths and core expertise in project finance we are often successful at placing project development loans. Submit a Project Finance Request now and we’ll get your financing started today.

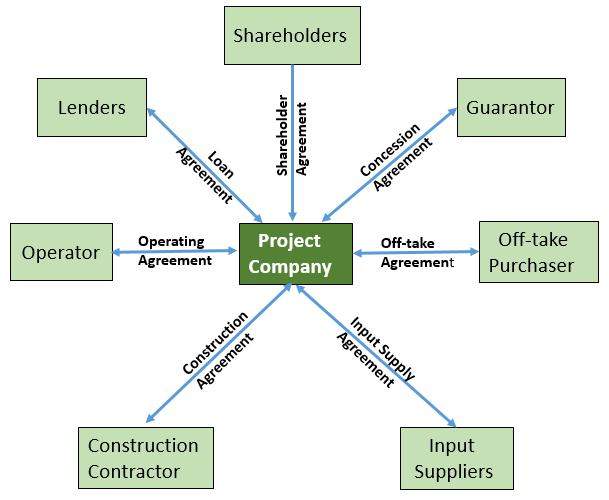

Project Finance Deal Structure

A typical project finance structure, simplified as an example , for a build- operate-transfer (BOT) project is shown.

The key elements are:

- Special Purpose Vehicle (SPV) project company with no previous business or record.

- Sole activity of project company is to execute the project contract – it subcontracts various aspects through construction contract and operations contract.

- For new build projects, there is no revenue stream during the construction phase and so debt service will only be possible once the project is online during the operations phase, thus there are significant risks during the construction phase.

- Sole revenue stream likely to be under an off-take or purchase agreement.

- Project finance loans are non-recourse as to the borrowers, including the project sponsors and shareholders of the project company.

- Project Finance Structure means the project remains off-balance sheet for the sponsors and for the host government.

Project Finance Details

Liberty Energy delivers long-term, limited recourse or non-recourse loans used to finance large commercial, industrial, infrastructure and sovereign projects worldwide.

Unique to project financing is the debt and repayment structure based on the projected cash flow of the project rather than the balance sheets of the project sponsor. Usually, a project finance structure involves a number of equity participants, who can be project sponsors or equity investors, and a consortium of lenders that provide loans to the project.

Project finance loans are almost always extended on a non-recourse or limited recourse basis and are secured by the project assets and operations. Repayment of the loans occurs entirely from project cash flow, not from the assets or credit of the borrower.

Underwriting for project development loans focuses on what is usually a business plan that includes extensive financial modeling and sensitivity analysis. The financing is typically secured by all of the project assets, including the revenue-generating components of the project. Lenders are granted a lien on all of the project assets and are further granted the right to assume managerial and operational control of a project, along with the mechanism to do so if the project doesn’t comply with the loan terms.

The borrower is typically a Special Purpose Entity or SPE which is created in the project finance documents specifically to own the project. The SPE ownership structure coupled with non-recourse debt effectively shields the assets of both the project sponsor and equity investors from collection efforts or deficiency actions if the project fails.

With collection actions barred if the deal fails, project lenders often require a commitment from the project owners to contribute capital to the project to ensure the project is sufficiently capitalized and financially sound, and also to demonstrate the project sponsors’ commitment to the deal.

Project finance is significantly more complex than traditional corporate finance or real estate lending. Historically international project finance has been used for mining, telecom, transportation and communication, water and electric utility distribution, and major public infrastructure projects.

Allocation of the risk among project participants is a key component of project finance. Project developments are often subject to technical, environmental, economic and political risks, particularly in developing countries and emerging markets. If the lenders or project sponsors determine that the risk exposure is too great during underwriting, the project is rendered non-financeable.

Long-term contracts for construction, supply, off-take, operations and concessions, along with contracts establishing joint-ownership of the project are structured in extensive project documentation to best align the interests and incentives of all the project participants. They are also designed to dissuade bad behavior on the part of the deal participants. In this way, project risk is allocated amongst the deal participants who are best able to manage the risk.

The amounts involved in project development financing are often so vast that no single lender could or should provide the entirety of the project financing. Instead, the project financing is often syndicated to a consortium of lenders to distribute the risk.

Limited recourse lending was used to finance maritime voyages in ancient Greece and Rome. Its use in infrastructure projects dates to the development of the Panama Canal, and was widespread in the US oil and gas industry during the early 20th century. However, project finance for high-risk infrastructure schemes originated with the development of the North Sea oil fields in the 1970s and 1980s

Contractual Framework

- Engineering, Procurement & Construction Contracts (EPC Contracts)

- Operation and maintenance agreement

- Concession deed

- Shareholders Agreement

- Off-take agreement

- Supply agreement

- Loan Agreement

- Intercreditor agreement

- Tripartite deed

- Common Terms Agreement

- Terms Sheet

Project Finance Parties

- Sponsor (typically also an Equity Investor)

- Lenders (including senior lenders and/or mezzanine)

- Off-taker(s)

- Contractor and equipment supplier

- Operator

- Financial Advisors

- Technical Advisors

- Legal Advisors

- Equity Investors

- Regulatory Agencies

- Multilateral Agencies / Export Credit Agencies

- Insurance Providers

- Hedge providers

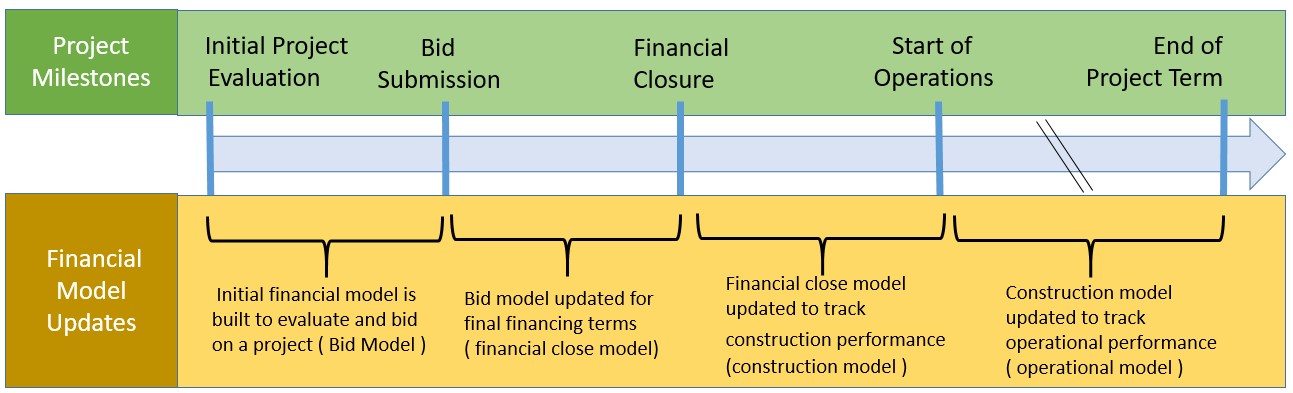

Financial Modeling

A project finance model is used throughout the project term and will need to get updated depending on the phase of the project. Below is an illustrative example of the evolution of a project finance model. Liberty Energy assists you in each step of your project financing quest.

Why Liberty Energy Group?

Our customers prefer working with us for our unparalleled financing and deal underwriting experience globally. Our responsiveness and a problem-solving approach where we use our specialized industry experience to deliver a one-on-one relationship with our clients is one of the many advantages Liberty Energy Group offers.